How to Determine Which Forecasting Model to Use Pro Forma

This is a hotly debated question. Using the same marketing example if you have a 12000 annual market budget at a 51 ROI then you can expect to bring in 60000 in sales.

Strategic And Operational Financial Planning Professor Xxxxx Course Name Number Ppt Download

1 The data is inaccurate.

. Balance Sheet assumptions include opening cash. Make sure they agree by using the reconciliation equation. If you do not know any modeling start with regression as it is most basic.

Collect revenue projection data. Before we get into how you can assess whether a forecasting model is reliable lets start with what forecasting actually is. The first is we key in what model it will use to forecast.

Weavers case we determined that this is 30. The forecast or pro-forma balance. A pro-forma forecast similar to any sort of pro-forma report is not required to abide by GAAP.

Business forecasting is essentially guessing or predicting or estimating future numbers such as future sales cost of sales and operating expenses by month quarter year and so on. A pro forma statement works as a prediction or a forecast of what your finances will look like based on your budget. Forecasting methods usually fall into three categories.

Since the test dataset is 12 periods long we set the horizon h to 12. Lack of time and money to invest in an expensive detailed financial model. No finance or accounting expertise.

Machine Learning Statistical and Expert. Using the coefficients from the table we can forecast the revenue given the promotion cost and advertising cost. 3 The data is a proxy for the decision-making criteria.

2 The data is produced with a lag and requires revision. The proportion of earnings retained in the company. Income Statement and Balance Sheet assumptions are modeled in seconds and automatically applied in our pro forma app.

Instead of y α β x ϵ you now have y α β 1 x 1. To prepare your pro forma income statement youll need to determine your estimated revenue projections. Made or carried out in a perfunctory manner or as a formality.

As a result they often reflect the best-case scenario which the. Pro Forma Financial Statement. Based on financial assumptions or projections.

Once youve set up your forecasting model you will then move onto interpreting it to formulate your best estimation of the future. Vacancy loss at 5. The first forecast that is computed with basic assumptions.

After this use your costs and revenue projections to find out what your future net income might be. It is one minus the payout ratio. Creating a pro forma will tell you how long it should take to pay for the repairs based on the increase in NOI.

How to Choose among Three Forecasting Models. Pro Forma EPS Acquirers Net Income Targets Net IncomeAcquirers shares outstanding New Shares Issued. In the Forecast End box determine your end date and hit Create.

When it comes to accounting pro forma statements are. Corporate tax rates flat tax rates or pass-through tax assumptions. Potential gross rental income 18000 20 21600.

It is called multiple linerar regression. β n x n ϵ where n represents the number of predictors covariates in your model. For example if we expect the promotion cost to be 125 and the advertising cost to be 250 we can use the equation in cell B20 to forecast revenue.

The necessity of a pro forma financial model. Financial forecasting is the process in which a company determines the expectations of future results. Based on the rent comparables you predict youll be able to raise the rent by 20 after the property is fully renovated.

A financial forecast is the primary aspect of any business plan. The biggest part of an investors due diligence. A pro forma version of the equation.

Financial modeling takes the financial forecasts and builds a predictive model that helps a. Easily Input and Test Key Inputs to See the Impact on Your Pro Forma. Pro Forma is the sum of all earning divided by the sum of all shares outstanding to get Pro Forma EPS.

According to Merriam-Webster pro forma means. So it is crucial to address them before jumping on any business decision. Then estimate all of your costs and liabilities such as loans rent payroll taxes etc.

Next we use the test_forecast command to compare the forecast against the actual value. External financing needed as a company grows. Statistical methods including time series models and regression analysis are.

Do research collect data and talk to accountants and experts in order to determine the companys normal annual revenue stream and asset acclamations. Pro forma is actually a Latin term meaning for form or today we might say for the sake of form as a matter of form. Each object is made using the forecast function which has two options.

Corporate tax assumptions include US. Access the sheet then select the line or bar graph option you want to use. Start with pro forma forecasting a process that calculates the companys estimated revenue projections.

Pro forma financial statements simply refer to a set of financial statements balance sheet income statement and cash flow statement which have been prepared in order to show the effects of a specific transaction on the historical financial statements of a business prior to the transaction actually taking place. Statistical models machine learning models and expert forecasts with the first two being automated and the latter being manual. Pro forma definition.

The second is the number of periods to forecast. The first step of the process is to determine the amount by which sales are expected to increase.

Irwin Mcgraw Hill C The Mcgraw Hill Companies Inc T4 2 Financial Planning Model Ingredients Sales Forecast Drives The Model Pro Forma Statements Ppt Download

Irwin Mcgraw Hill C The Mcgraw Hill Companies Inc T4 2 Financial Planning Model Ingredients Sales Forecast Drives The Model Pro Forma Statements Ppt Download

Financial Forecasting A Small Business Guide The Blueprint

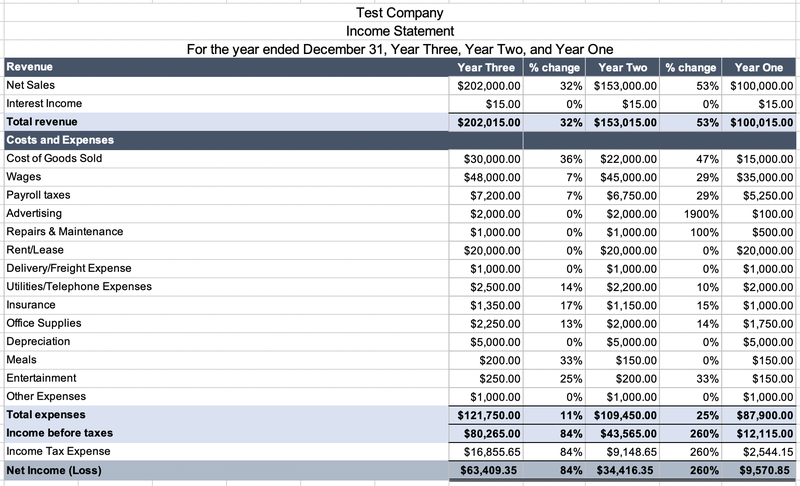

Solved Please Help With Pro Forma Income Statement And Chegg Com

Chapter 4 Long Term Financial Planning And Corporate Growth Ppt Video Online Download

Irwin Mcgraw Hill C The Mcgraw Hill Companies Inc T4 2 Financial Planning Model Ingredients Sales Forecast Drives The Model Pro Forma Statements Ppt Download

Financial Planning And Control Chapter 8 Financial Planning

Blended Value Business Plan Pro Forma Income Statement User

Cold Storage Service Excel Financial Model Oak Business Consultant

Blended Value Business Plan Pro Forma Income Statement User

Irwin Mcgraw Hill C The Mcgraw Hill Companies Inc T4 2 Financial Planning Model Ingredients Sales Forecast Drives The Model Pro Forma Statements Ppt Download

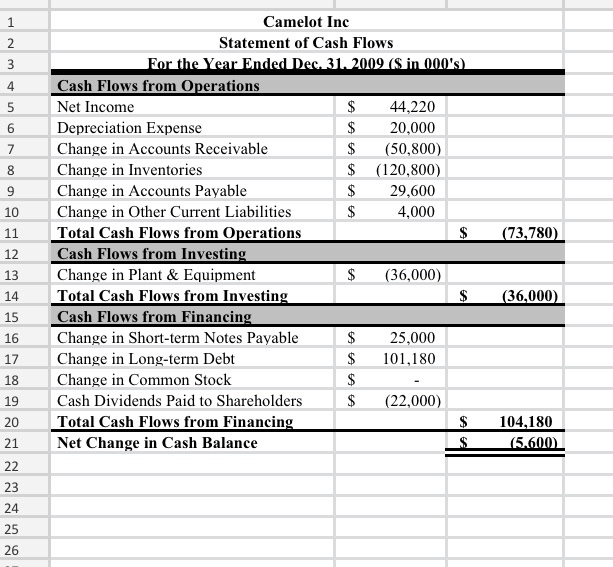

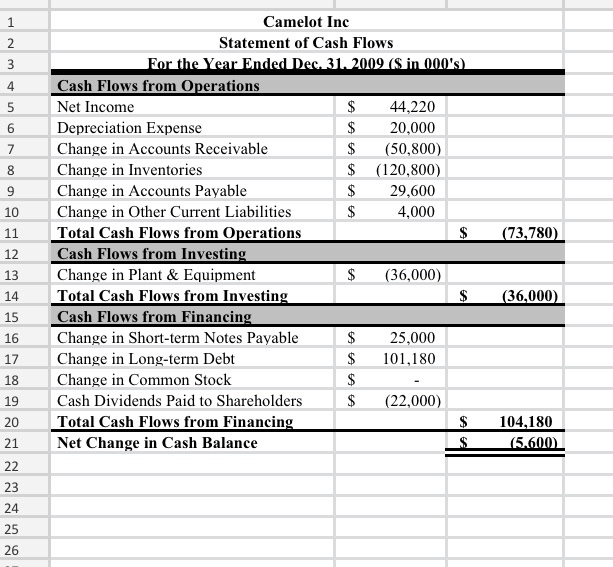

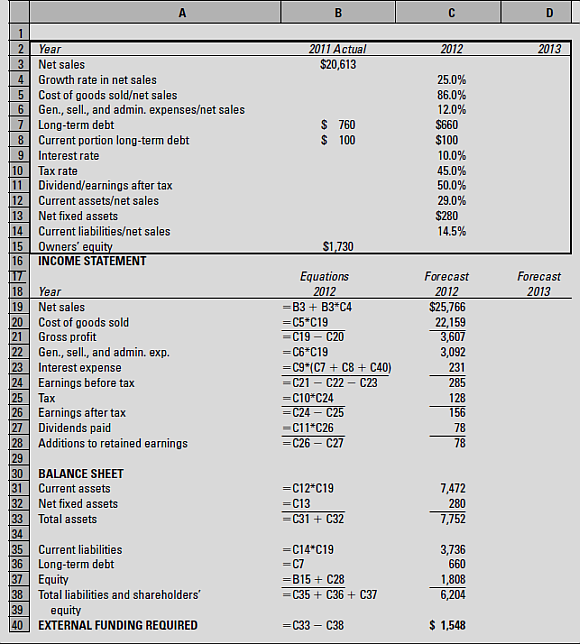

Solved An Excel Spreadsheet Containing R E Supplies 2012 Pro For Chegg Com

Chapter 4 Long Term Financial Planning And Corporate Growth Ppt Video Online Download

Chapter 12 Financial Planning And Forecasting Financial Statements Answers To End Of Chapter Questions

Irwin Mcgraw Hill C The Mcgraw Hill Companies Inc T4 2 Financial Planning Model Ingredients Sales Forecast Drives The Model Pro Forma Statements Ppt Download

Irwin Mcgraw Hill C The Mcgraw Hill Companies Inc T4 2 Financial Planning Model Ingredients Sales Forecast Drives The Model Pro Forma Statements Ppt Download

Pdf Prospective Analysis Guidelines For Forecasting Financial Statements

Comments

Post a Comment